How to Create a Zimpler Account?

Creating a Zimpler account is a straightforward process that can be done in a few simple steps. Zimpler is an online payment solution that allows users to make quick and secure payments without the need for a credit card. With Zimpler, users can easily make deposits and withdrawals at online casinos and pay for goods and services at online stores.

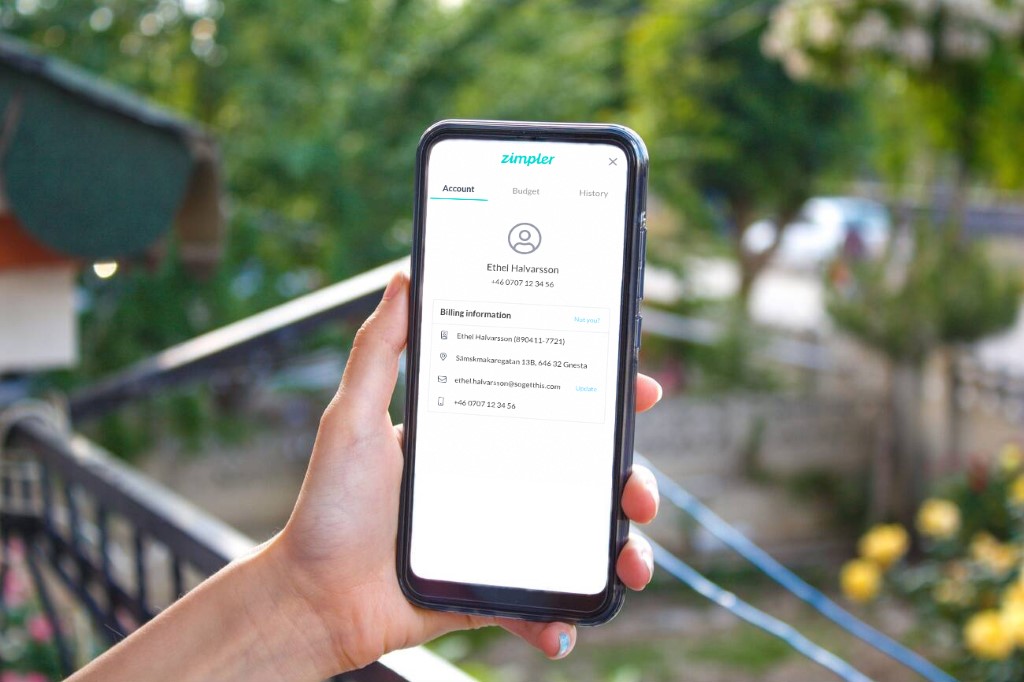

To create a Zimpler account, users must visit the Zimpler website or download the Zimpler mobile app. Once their account is set up, they can link their payment methods to their Zimpler account and start making payments. Zimpler offers world-class security and reliability.

Setting Up a Zimpler Account

Creating a Zimpler account is a straightforward process that can be completed in just a few minutes. Here is a step-by-step guide on how to create your Zimpler account:

Registration Process

To start the registration process, visit the Zimpler website and click the “Sign Up” button. You will be prompted to enter your email address and create a password. Once you have entered this information, click on the “Create Account” button.

Phone Number Verification

After creating your account, you will need to verify your phone number. Zimpler will send a verification code to your phone via SMS. Enter the code into the verification field on the Zimpler website to complete the verification process.

Personal Information Entry

Once your phone number has been verified, you will be asked to enter your personal information. This includes your name, date of birth, and address. You will also need to provide your bank account details to make deposits and withdrawals using Zimpler.

It is worth noting that Zimpler takes the security of your personal information seriously and uses industry-standard encryption to protect your data. Additionally, Zimpler is fully licensed and regulated by the Swedish Financial Supervisory Authority, ensuring that your funds are safe and secure.

In summary, setting up a Zimpler account is a quick and easy process involving registering, verifying your phone number, and entering your personal information. Zimpler takes the security of your information seriously and is fully licensed and regulated by the Swedish Financial Supervisory Authority.

Using Zimpler for Transactions

Depositing Funds

To deposit funds into your Zimpler account, you can link your bank account or card to your Zimpler account. Once you have done this, you can use Zimpler as a payment method on any site that accepts it. To make a deposit, simply select Zimpler as your payment method and enter the amount you wish to deposit. You will then be prompted to confirm the transaction, after which the funds will be deposited into your account.

Making Withdrawals

To withdraw funds from your Zimpler account, you can use the same method you used to deposit funds. Simply select Zimpler as your withdrawal method and enter the amount you wish to withdraw. You will then be prompted to confirm the transaction, after which the funds will be withdrawn from your account and deposited into your linked bank account or card.

Transaction Confirmation

Whenever you make a transaction using Zimpler, you will receive a confirmation message via SMS or email. This message will contain transaction details, including the amount, the date and time, and the recipient. You should always check this message to ensure that you authorised the transaction and that the details are correct.

Zimpler provides a secure and reliable way to make payments and withdrawals online. With its world-class security and innovative features, Zimpler is at the forefront of online payment technology. Whether depositing funds into your account or withdrawing, you can be confident that your transaction will be processed quickly and securely.

Zimpler Account Management

Accessing Your Account

To access your Zimpler account, you need to have created one first. If you still need to create an account, you can do so by following the steps provided on the Zimpler website. Once you have an account, you can log in using your mobile phone number and the PIN code sent to you via SMS.

Setting Spending Limits

Zimpler allows you to set spending limits on your account to help you manage your spending. You can set daily, weekly, or monthly limits on how much you can spend using Zimpler. To set a limit, log in to your Zimpler account and go to the “Settings” section. From there, you can set your desired limit.

Account Security

Zimpler takes account security seriously and has implemented various measures to ensure your account is secure. When you log in to your account, you need to provide a PIN code that is sent to your mobile phone. This ensures that only you can access your account.

Zimpler also uses world-class security measures to protect your account and personal information. All transactions are encrypted and secured using SSL technology, ensuring your information is safe and secure.

In addition, Zimpler allows you to view your transaction history, which allows you to keep track of all your transactions and ensure that there are no unauthorised transactions on your account.

Overall, managing your Zimpler account is straightforward. With features such as spending limits and world-class security measures, you can be confident that your account and information are secure.

Payment Methods with Zimpler

Zimpler offers a variety of payment methods to its users. Here are some of the most popular payment methods that you can use to fund your Zimpler account:

Linking Bank Accounts

Linking your bank account to Zimpler is a quick and easy process. Once you have created your Zimpler account, you can link your bank account by following these steps:

- Log in to your Zimpler account.

- Click on the “Link Bank Account” button.

- Select your bank from the list of available banks.

- Enter your online banking login credentials.

- Follow the prompts to complete the linking process.

Once your bank account is linked to Zimpler, you can easily transfer funds to and from your Zimpler account.

Using Credit Cards

Zimpler also supports credit card payments. To use a credit card to fund your Zimpler account, follow these steps:

- Log in to your Zimpler account.

- Click on the “Add Credit Card” button.

- Enter your credit card information.

- Follow the prompts to complete the payment process.

Please note that Zimpler charges a small fee for credit card transactions.

E-Wallet Options

Zimpler also supports a variety of e-wallet options, including PayPal and Skrill. To use an e-wallet to fund your Zimpler account, follow these steps:

- Log in to your Zimpler account.

- Click on the “Add E-Wallet” button.

- Select your preferred e-wallet from the list of available options.

- Follow the prompts to complete the payment process.

Using an e-wallet to fund your Zimpler account is a quick and easy way to start with Zimpler.

Zimpler’s payment methods are designed to make it easy for users to fund their accounts and start using the service. Whether you prefer to use a bank account, credit card, or e-wallet, Zimpler has a payment method that will work for you.

Zimpler in Different Countries

Zimpler is a payment method that is currently available in Sweden and Finland. It is a pay-by-phone payment method that allows users to easily make payments. Zimpler is a reliable and secure payment method that many people trust.

Using Zimpler in Sweden

Zimpler is a popular payment method in Sweden. The payment method is easy to use and offers fast transactions. To use Zimpler in Sweden, you must create an account and link your payment methods. Once you have done this, you can use your phone to make payments.

Zimpler is a safe and secure payment method that the Swedish Financial Supervisory Authority regulates. This means that your transactions are protected and your personal information is kept confidential.

Using Zimpler in Finland

Zimpler is available in Finland. The payment method is easy to use and offers fast transactions. To use Zimpler in Finland, you need to create an account and link your payment methods. Once done, you can use your phone to make payments.

Zimpler is a safe and secure payment method that the Finnish Financial Supervisory Authority regulates. This means that your transactions are protected and your personal information is kept confidential.

Zimpler Availability in Canada

Currently, Zimpler is not available in Canada. However, Zimpler is constantly expanding its services and may become available in Canada. If you are in Canada and are interested in using Zimpler, you can check their website for updates on availability.

In conclusion, Zimpler is a reliable and secure payment method currently available in Sweden and Finland. It is easy to use and offers fast transactions. If you are in Sweden or Finland, Zimpler is definitely worth considering as a payment method.

Zimpler for Online Casinos

Zimpler is a popular payment method that allows players to make quick and secure transactions at online casinos. Here’s what you need to know about using Zimpler for online casino gaming.

Zimpler Casino Deposits

To make a deposit at a Zimpler casino, you’ll need to follow these steps:

- Choose an online casino that accepts Zimpler as a payment method.

- Create a Zimpler account by entering your mobile number and following the instructions.

- Go to the cashier section of the online casino and select Zimpler as your payment method.

- Enter the amount you want to deposit and confirm the transaction.

- The funds should be available in your online casino account immediately.

Mobile Casino Payments

Zimpler is a mobile app making it easy to make payments on the go. To use Zimpler for mobile casino payments, you’ll need to:

- Download the Zimpler app from the App Store or Google Play.

- Create a Zimpler account by entering your mobile number and following the instructions.

- Go to the cashier section of the mobile casino and select Zimpler as your payment method.

- Enter the amount you want to deposit and confirm the transaction.

- The funds should be available in your mobile casino account immediately.

Zimpler Casino Withdrawals

Zimpler can also be used for withdrawals at some online casinos. To withdraw your winnings using Zimpler, follow these steps:

- Go to the cashier section of the online casino and select Zimpler as your withdrawal method.

- Enter the amount you want to withdraw and confirm the transaction.

- The funds should be transferred to your Zimpler account within a few hours.

- You can then withdraw the funds from your Zimpler account to your bank account or use them for other online purchases.

Overall, Zimpler is a convenient and secure payment method for online casino gaming. Its mobile app and fast transactions make it a great choice for players who want to enjoy their favourite casino games on the go.

Zimpler Charges and Fees

Understanding Deposit Fees

When creating a Zimpler account, there are no fees or charges. However, Zimpler charges a fee when making a deposit, which varies depending on the deposit method used. The fee is usually a percentage of the deposit amount and is deducted from the deposit amount before it is credited to the Zimpler account.

For example, if you deposit £100 and the deposit fee is 2%, Zimpler will charge you £2, and your Zimpler account will be credited with £98.

It is essential to note that the deposit fee is not charged by the casino or merchant but by Zimpler. Therefore, checking the deposit fee before making a deposit is important to avoid any surprises.

Identifying Withdrawal Charges

Zimpler does not charge any fees for withdrawals. However, some casinos or merchants may charge a withdrawal fee or have a minimum amount. Therefore, it is essential to check the casino or merchant’s terms and conditions before withdrawing.

It is also important to note that Zimpler may charge a fee for failed transactions or chargebacks. A chargeback occurs when a customer disputes a transaction and requests a refund from their bank. Zimpler may charge a fee to cover the chargeback costs in such cases.

In summary, Zimpler charges a deposit fee that varies depending on the deposit method used. The fee is deducted from the deposit amount before it is credited to the Zimpler account. Zimpler does not charge any withdrawal fees, but some casinos or merchants may charge a withdrawal fee or have a minimum withdrawal amount. It is important to check the casino or merchant’s terms and conditions before withdrawing.

Zimpler Customer Support

Zimpler offers customer support to its users to help them with any issues they may face while using the platform. The customer support team is knowledgeable and can help with various issues.

Users can contact Zimpler’s customer support via email or live chat. The live chat feature is available on the Zimpler website and is the quickest way to contact customer support. The customer support team is available 24/7 to help users with any issues.

Zimpler’s customer support team is well-trained and can help with various issues, including account creation, payment issues, and general enquiries. They can also help users with any issues related to security and fraud prevention.

If users need help with any payment-related issues, the customer support team can help them resolve the issue quickly. They can also help users with any issues related to account verification and guide how to complete the process.

Overall, Zimpler’s customer support team is knowledgeable and efficient in resolving user issues. Users can contact them via email or live chat and can expect a prompt response.

Additional Features of Zimpler

Zimpler offers several additional features, making it a convenient and secure payment method. Here are some of the main features of Zimpler:

Zimpler Go

Zimpler Go is a feature that allows you to make payments without creating an account. You can use Zimpler Go to make payments by entering your mobile phone number and verifying the payment with a code sent to your phone. This feature is ideal for those who want to avoid creating an account or for one-time payments.

Zimpler E-Wallet

Zimpler E-Wallet is a feature that allows you to store your payment information securely in one place. You can link your bank account or credit card to your Zimpler E-Wallet and use it to make payments without entering your payment information every time. This feature is ideal for those who make frequent payments or want to keep their payment information in one place.

With Zimpler E-Wallet, you can also set limits on your spending and receive notifications when you reach your limit. This feature can help you manage your finances and avoid overspending.

Zimpler also offers a feature called “My Pages” where you can manage your account settings, view your payment history, and set limits on your spending. This feature is useful for those who want to keep track of their payments and manage their finances.

Overall, Zimpler offers several additional features that make it a convenient and secure payment method. Whether you want to make one-time payments or manage your finances, Zimpler has a feature that can meet your needs.

Zimpler’s Terms and Conditions

Before creating a Zimpler account, it is important to understand the terms and conditions of using the payment service. Zimpler AB is a Swedish payment institution that provides a bank-independent payment solution for account-to-account bank transfers. As such, it is regulated by the Swedish Financial Supervisory Authority (Finansinspektionen).

The terms and conditions for using Zimpler can be found on their website. The document outlines the rules and regulations users must abide by when using the service. Some of the key points to note include:

- Users must be at least 18 years old to use Zimpler.

- Users must provide accurate and up-to-date information when creating an account.

- Zimpler reserves the right to refuse service to anyone for any reason.

- Users are responsible for keeping their account information secure and confidential.

- Zimpler may charge fees for certain transactions, which will be clearly stated at the time of the transaction.

- Users must not use Zimpler for any illegal or fraudulent activities.

Users need to read and understand the terms and conditions before creating a Zimpler account. Users agree to abide by these rules and regulations by using the service.

In addition to the general terms and conditions, Zimpler has specific terms for certain services, such as invoicing. Users should review these terms carefully before using these services.

Overall, Zimpler’s terms and conditions are designed to protect both the company and its users. By following these rules and regulations, users can ensure a safe and secure experience when using the payment service.

Frequently Asked Questions

What is Zimpler and how can it benefit me?

Zimpler is a pay-by-phone payment method that allows users to make deposits and withdrawals at online casinos. It is fast, secure, and convenient and can be used on mobile devices and desktop computers. Zimpler also offers features such as budgeting tools and spending limits to help users manage their gambling activity.

Where can I use Zimpler as a payment method?

Zimpler is currently available in Sweden and Finland, but it may expand to other countries in the future. It can be used at many online casinos, so it’s worth checking if your preferred casino accepts Zimpler payments.

What are the steps to create a Zimpler account?

To create a Zimpler account, visit the Zimpler website and sign up with your mobile phone number and email address. You will then need to link your payment methods, such as your bank or credit card, to your Zimpler account. Once this is done, you can start using Zimpler to make payments at online casinos.

Does Zimpler charge any fees for transactions?

Zimpler does not charge any fees for making deposits or withdrawals at online casinos. However, your bank may charge fees for using Zimpler, so it’s worth checking with them before using this payment method.

Can I use Zimpler in my country?

Zimpler is currently only available in Sweden and Finland, but it may expand to other countries in the future. Keep an eye on the Zimpler website for updates on where this payment method is available.

Is there a Zimpler API available for developers to use?

Yes, Zimpler offers an API that developers can use to integrate Zimpler payments into their own websites or applications. The API is well-documented and easy to use, making it a popular choice for developers who want to offer their users Zimpler as a payment option.